Our Business

Our Business

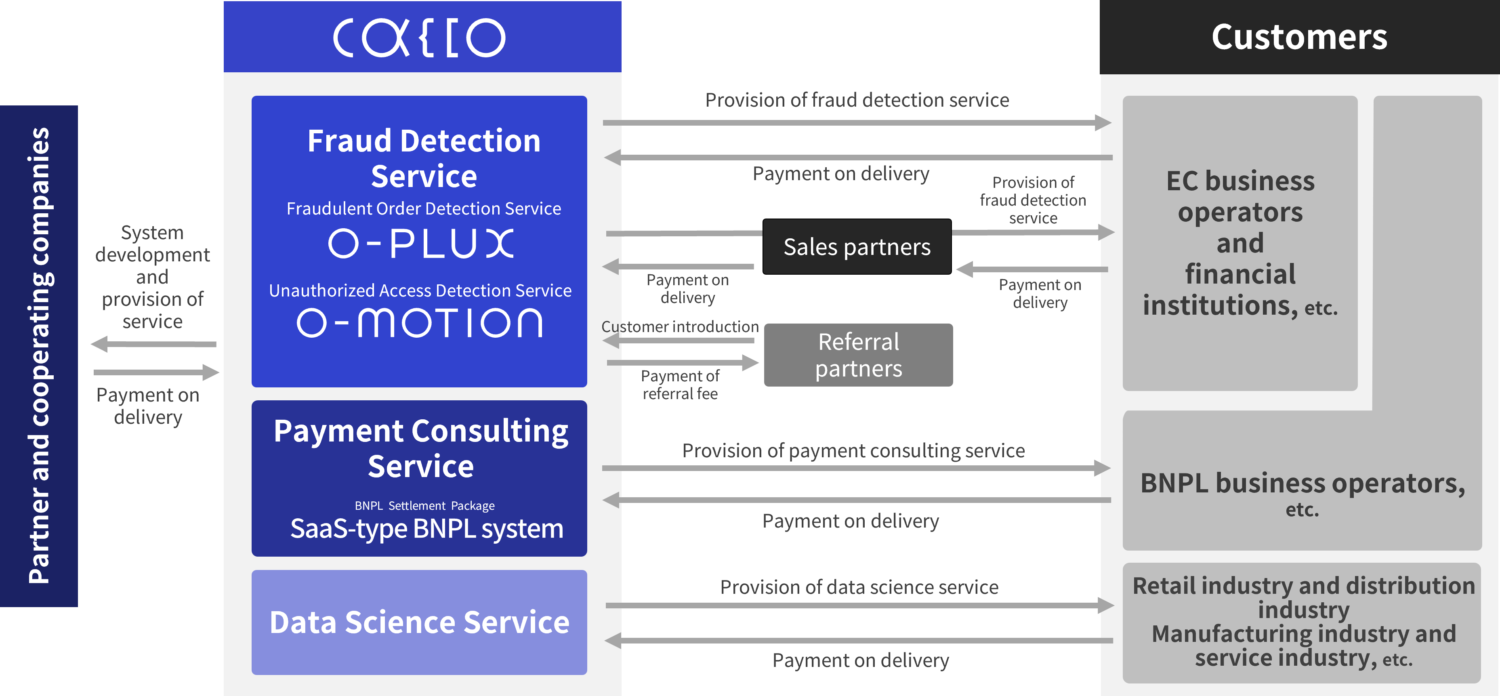

The Company develops and provides algorithms and software based on its data science technology and know-how to help companies solve problems and take on challenges in the "SaaS algorithm provision business".

Especially, in the field of e-commerce, as a countermeasure against fraud in online payments, which have been rapidly increasing in recent years, we have developed a "fraud detection service" whose main product is "O-PLUX," a SaaS service that detects potential unpaid orders in real time, and position it as the core service of our business.

In addition, as a synergy service with the "Fraud Detection Service," we offer the "Payment Consulting Service," which provides a system and consulting services to post-payment settlement service providers* that offer payment after receiving goods without using credit cards. By using "O-PLUX" as a screening engine for post-payment settlement, we provide a one-stop service.

In order to expand the "SaaS algorithm provision business" not only in the e-commerce field but also in various other fields including retail/distribution and manufacturing, we are developing "data science services" to develop and provide algorithms that contribute to marketing and production efficiency improvement.

The details of each service are as follows.

We are a single segment in the SaaS algorithm provision business, so the information is presented by service.

Providers that offer deferred payment, a payment method in which goods are received first and paid for later, without using a credit card. For example, by receiving an assignment of accounts receivable from a distributor to a purchaser, the company makes advance payments to the distributor for goods and other items, and a deferred payment settlement company collects the receivables on behalf of the distributor.

Services

(1) Fraud Detection Service

Based on our data science and security technologies and know-how, we offer the following fraud detection services.

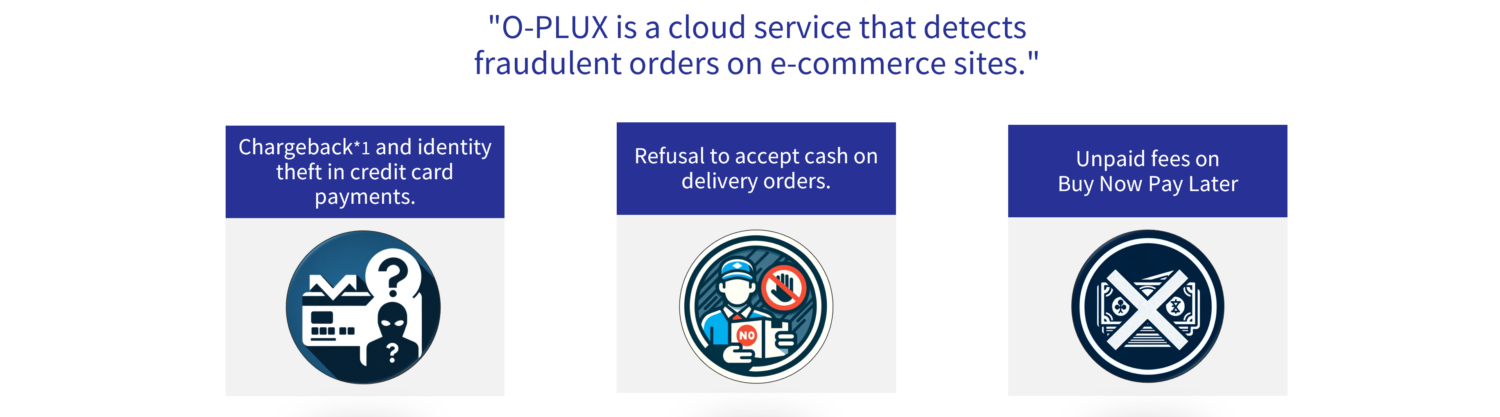

a.Fraudulent Order Detection Service "O-PLUX"

O-PLUX

is a cloud service

to detect fraudulent orders on e-commerce sites.

O-PLUX is a SaaS-based fraudulent order detection service that analyzes EC order data to detect potentially unpaid orders in real time.We have built a unique detection model using our data science techniques such as AI, statistics, and mathematical optimization, for example, normalization function for Japanese notational distortion *2 and device authentication function to identify the terminal where the order was placed *3. These features enable detection accuracy that could not be achieved by simple blacklist matching or visual inspection by a staff member.In addition, unlike identity authentication services that require a password to be entered at the time of purchase, O-PLUX allows screening without screen transitions, thus enabling anti-fraud measures without compromising the purchaser's operability and convenience. "O-PLUX" has been highly evaluated for these functions and performance, and has won the largest number of installations of paid fraud detection services on e-commerce sites in Japan. *According to the "Survey on EC Site Fraud Detection Services" conducted by Tokyo Shoko Research, Inc. The survey was conducted as of the end of May 2020.

- The credit card company demands that the credit card holder cancel or refund the payment of the sales price to the EC business because the credit card holder does not agree to pay for the use, such as in the event of fraudulent use.

- A function that transforms the same information with different notations based on certain rules and aligns the notations. For example, "1-chome 5-ban 31-go Akasaka" and "1-5-31 Akasaka.

- A function that identifies the terminal where the order was placed based on various information and settings about the terminal, such as IP address, cookie, language settings, etc.

<Fraud Countermeasures for EC Businesses>

In recent years, there has been a sharp increase in the number theft of credit card numbers and other information that is stolen and used fraudulently.In the event of unauthorized use of a credit card in EC, if the credit card holder applies to the credit card company to cancel the order without agreeing to pay the price, the sales for that price will be canceled and the EC business will basically be responsible for the payment. O-PLUX is being introduced to e-commerce businesses as a tool to prevent frauds in e-commerce, such as credit card fraud, refusal to accept cash-on-delivery orders, and spoofing of orders for affiliate commissions.

<Screening Engine for Postpaid Payment Service Providers>

The number of users of postpaid payment, which allows payment after receiving goods without using a credit card, is expanding in response to the needs of users who are concerned about using credit cards. According to the "Current Status and Future Forecast of Online Payment Service Providers 2020 Edition" by Yano Research Institute Ltd.

Compared to credit card payment, postpaid payment does not require prior screening and basically requires screening based on order information only, which increases the risk of nonpayment and requires more accurate screening. The risk of non-payment is basically borne by the deferred payment service provider, and O-PLUX is used as a countermeasure.

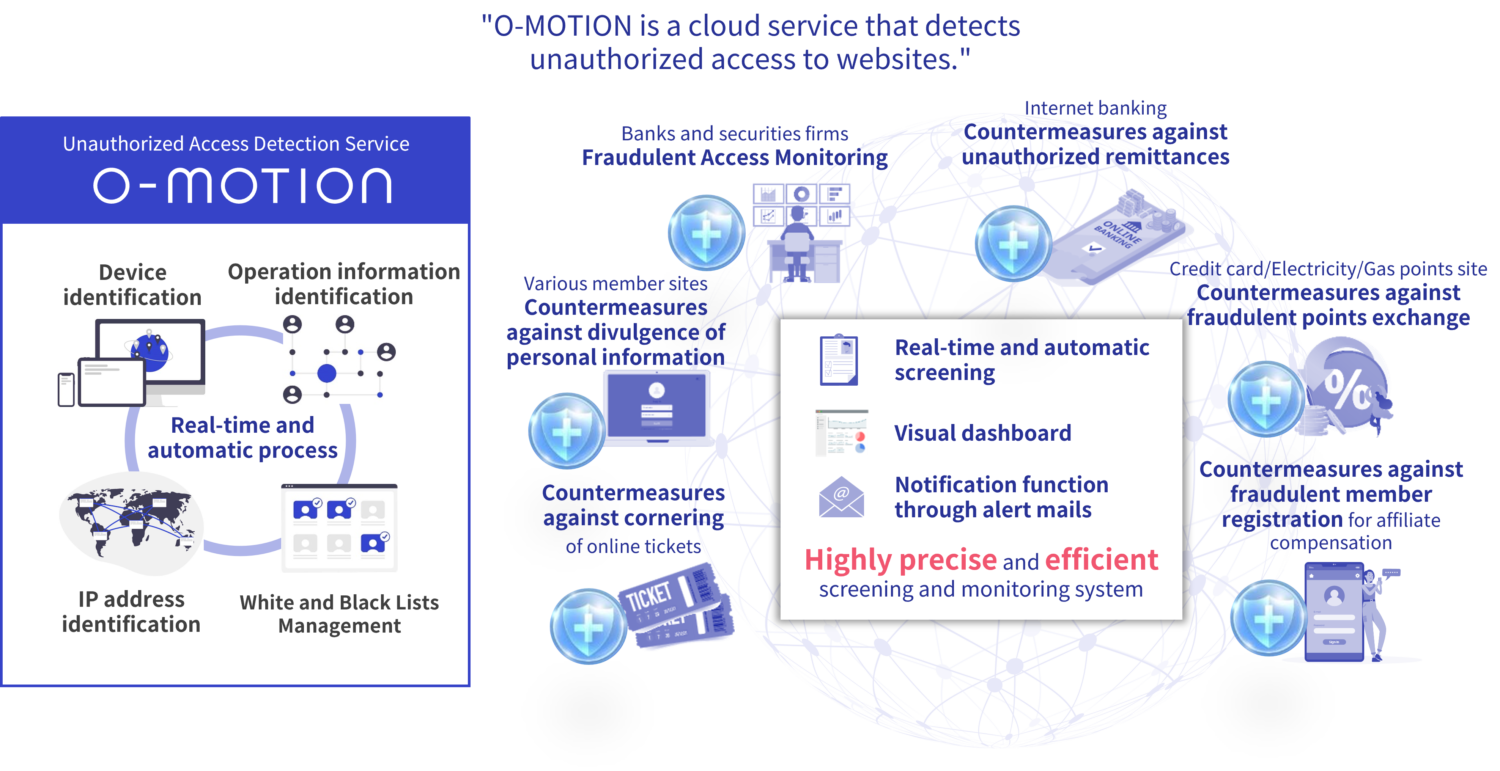

b.Unauthorized Access Detection Services "O-MOTION"

O-MOTION is a SaaS-type unauthorized access detection service that detects unauthorized access to member sites in real time.O-MOTION can detect fraud that cannot be detected by conventional detection methods such as User Agent* and cookies by using device information and operation information. The performance of the system has been highly evaluated, and the system has been introduced by financial institutions and major ticket websites as a countermeasure against unauthorized remittances in Internet banking and resale of tickets at high prices by unauthorized ticket buyers, which is regulated by the so-called "Ticket Fraudulent Resale Prevention Law" that went into effect in June 2019.

An identifier that is a combination of information such as browser type and version and OS type and version that is automatically notified by the browser to the Web server.

(2)Payment Consulting Services

Our settlement consulting service mainly provides settlement systems and consulting on the start-up and operation of deferred payment settlement businesses based on our know-how on deferred payment settlement to deferred payment settlement providers.

While post-payment settlement is highly convenient for purchasers, it requires highly accurate screening because it increases the risk of nonpayment and other collection risks for the post-payment settlement service providers.Along with providing "settlement consulting services," we offer one-stop support for the establishment of deferred payment settlements through the use of "O-PLUX" as a screening engine for deferred payment settlements.

(3)Data Science Service

Our data science service analyzes big data owned by companies using the best techniques in data science, such as AI, statistics, and mathematical optimization, and develops and provides algorithms to address issues such as marketing and business productivity. We provide highly transparent services by setting fees for each phase, such as the basic tabulation phase, analysis phase, and system construction phase The examples of this service are as follows.

(a)

Clustering of customer characteristics by "buying style" based on purchasing data for all apparel manufacturers' physical stores and e-commerce. (Collecting data separately by function or category.)。Generation of a monthly list of members in order of expected purchase value and provision of materials for planning cluster-specific measures and communications.

(b)

Forecast demand for the call center on a daily and hourly basis for the following month. Based on current response capacity, the system calculates and automatically provides a staffing plan that satisfies multiple constraints, such as response rates that meet management indicators, employee work preferences, and working conditions.

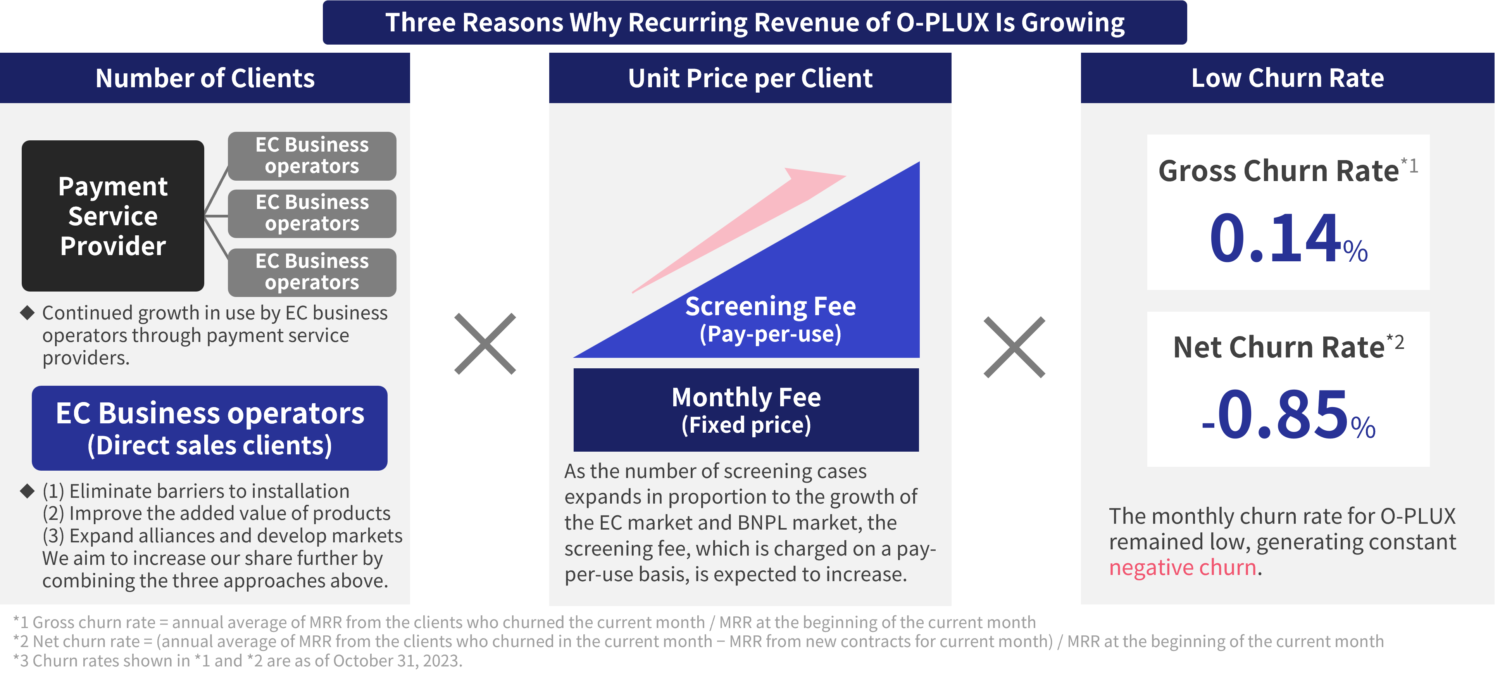

About Our Business Model

The revenue structure of our main product, "O-PLUX," is composed of stock revenue, which consists of a fixed monthly fee and an audit fee based on the number of audits, and spot revenue, such as initial installation fees. In the fiscal year ending December 31, 2019, stock revenue will account for 70.3% of total revenue.

In order to realize growth in stock earnings, we will aim to increase the number of companies using our products and the number of examinations, and to maintain a high retention rate by improving customer value through further accuracy improvement based on our data science technology and by providing a monitoring and support system that is unique to our domestic and in-house products.

Business Chart

The Company's business chart is shown in the figure below.